Young Home Buyers in Vermont: What to Know

Legal Age to Buy a Home in Vermont

Under Vermont law, a person must be at least 18 years old to sign a legally enforceable contract, including a purchase and sale agreement for real estate. Anyone younger than 18 is considered a minor and lacks full legal capacity to contract.

Because of this, mortgage lenders, title companies, and real estate attorneys will not proceed with a sale unless the buyer is 18 or older. This ensures that all parties have full legal capacity to enter and be bound by the terms of the transaction.

Why the Law Requires Age 18

Vermont, like other states, bases its age of majority on the idea that adults (18 and older) are legally capable of understanding and managing the obligations that come with homeownership. Buying a home involves complex, long-term commitments—mortgages, insurance, taxes, and maintenance—that require full contractual capacity.

At 18, an individual gains the legal authority to:

• Sign a mortgage or deed

• Take title to property in their own name

• Be responsible for taxes, liens, and insurance obligations

• Enforce or defend property rights in court

Advantages of Starting Homeownership Young

For those just reaching adulthood, buying a home early in life offers several potential advantages:

1. Building Equity Sooner: Every mortgage payment increases ownership stake in the property, creating long-term wealth.

2. Stability and Independence: Owning a home provides a sense of financial and personal stability—especially valuable for young professionals settling in Vermont.

3. Tax Benefits: Homeowners may qualify for deductions such as mortgage interest and property tax.

4. Appreciation Over Time: Vermont real estate has historically appreciated in value, particularly in desirable areas near Burlington, Williston, and the Upper Valley.

Starting young allows more years for appreciation and equity growth, which can make a significant difference in lifetime financial security.

Challenges of Qualifying for a Mortgage When Starting Out

Despite the benefits, buying a home early also comes with challenges—especially qualifying for a mortgage. Younger buyers may struggle with:

• Limited credit history: Lenders look for a consistent track record of managing debt responsibly.

• Lower income or savings: Meeting down payment and debt-to-income requirements can be difficult when starting a career.

• Student loan debt: Many young Vermonters carry educational loans, which can reduce borrowing capacity.

First-time buyers can improve their chances by saving for a larger down payment, building strong credit, and exploring programs like FHA loans or Vermont Housing Finance Agency (VHFA) assistance, which help make ownership more affordable.

What Happens if Someone Under 18 Inherits Real Estate?

A person younger than 18 cannot hold legal title to real estate in their own name in Vermont. However, if a minor inherits property—say, through a will or estate—the law provides mechanisms to protect and manage it until they reach adulthood.

Typically, one of the following applies:

• A guardian of the estate is appointed by the Probate Court to manage the property on the minor’s behalf.

• The property is placed in a trust, managed by a trustee until the minor turns 18.

• In some cases, the property can be sold under court supervision, with proceeds held for the minor.

Once the individual reaches 18, full ownership transfers to them, and they gain the right to sell, mortgage, or otherwise manage the property.

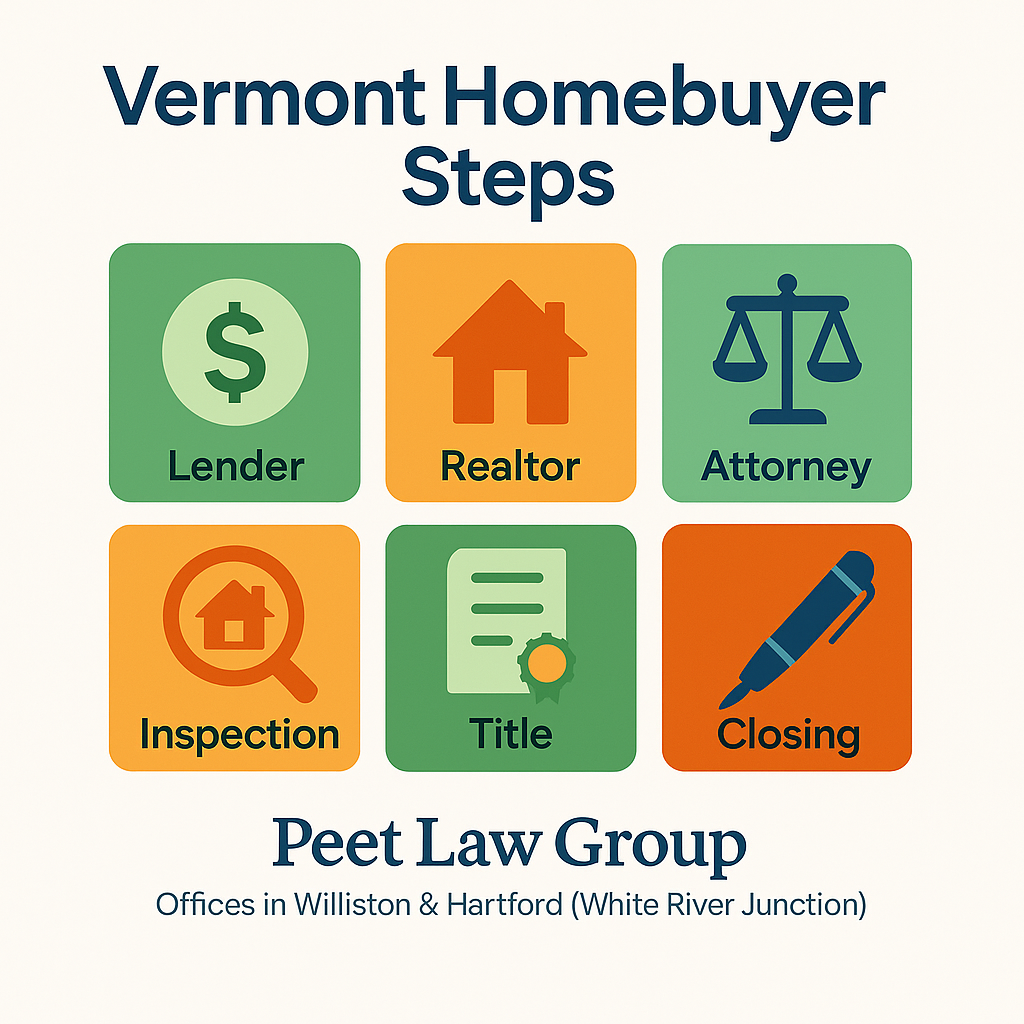

Professional Guidance Matters

Even for adults, real estate transactions involve significant legal and financial complexity. For younger buyers or families dealing with inherited property for minors, experienced legal guidance ensures that everything is handled correctly.

At Peet Law Group, with offices in Williston and Hartford (White River Junction), Vermont, our attorneys help clients of all ages navigate Vermont’s real estate laws—whether purchasing a first home, managing inherited property, or transferring title.

If you have questions about buying property or managing inherited real estate in Vermont, contact Peet Law Group at www.peetlaw.com for experienced legal guidance.