October 1, 2025

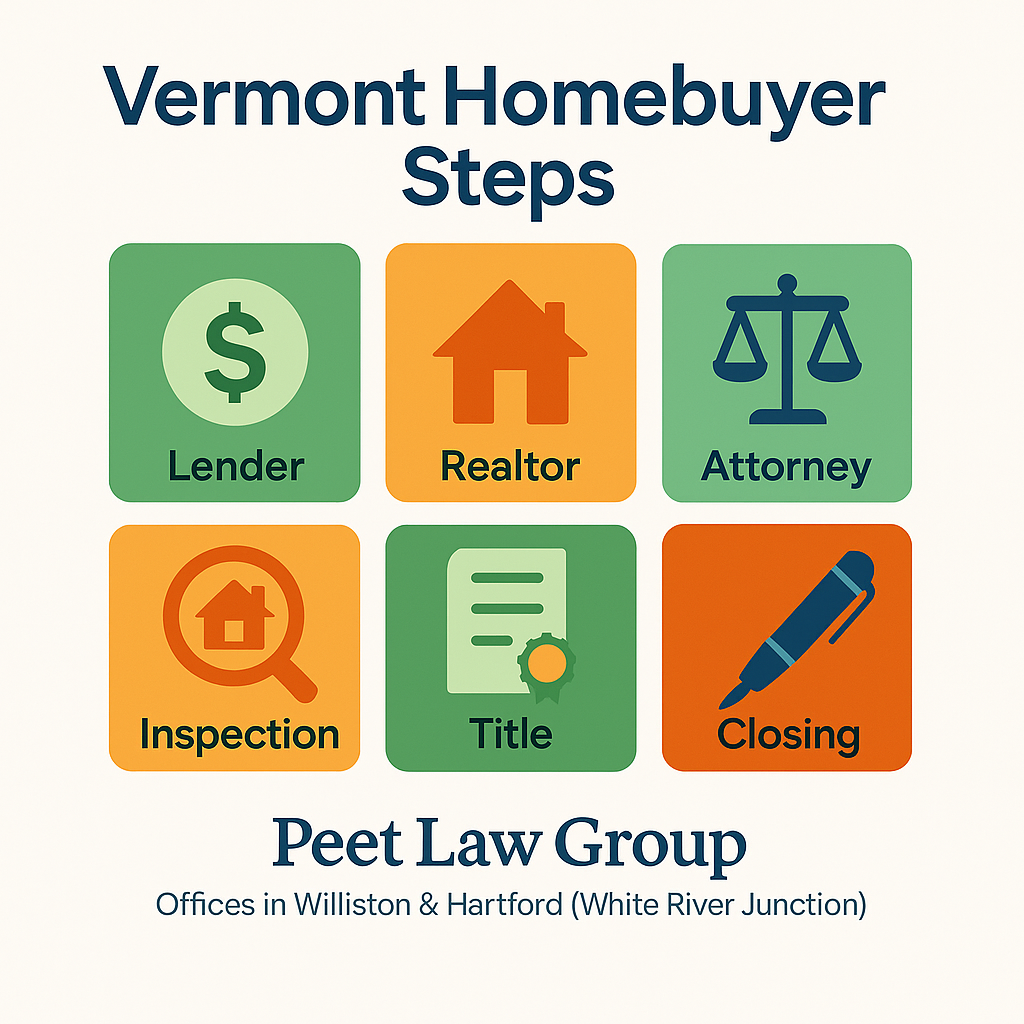

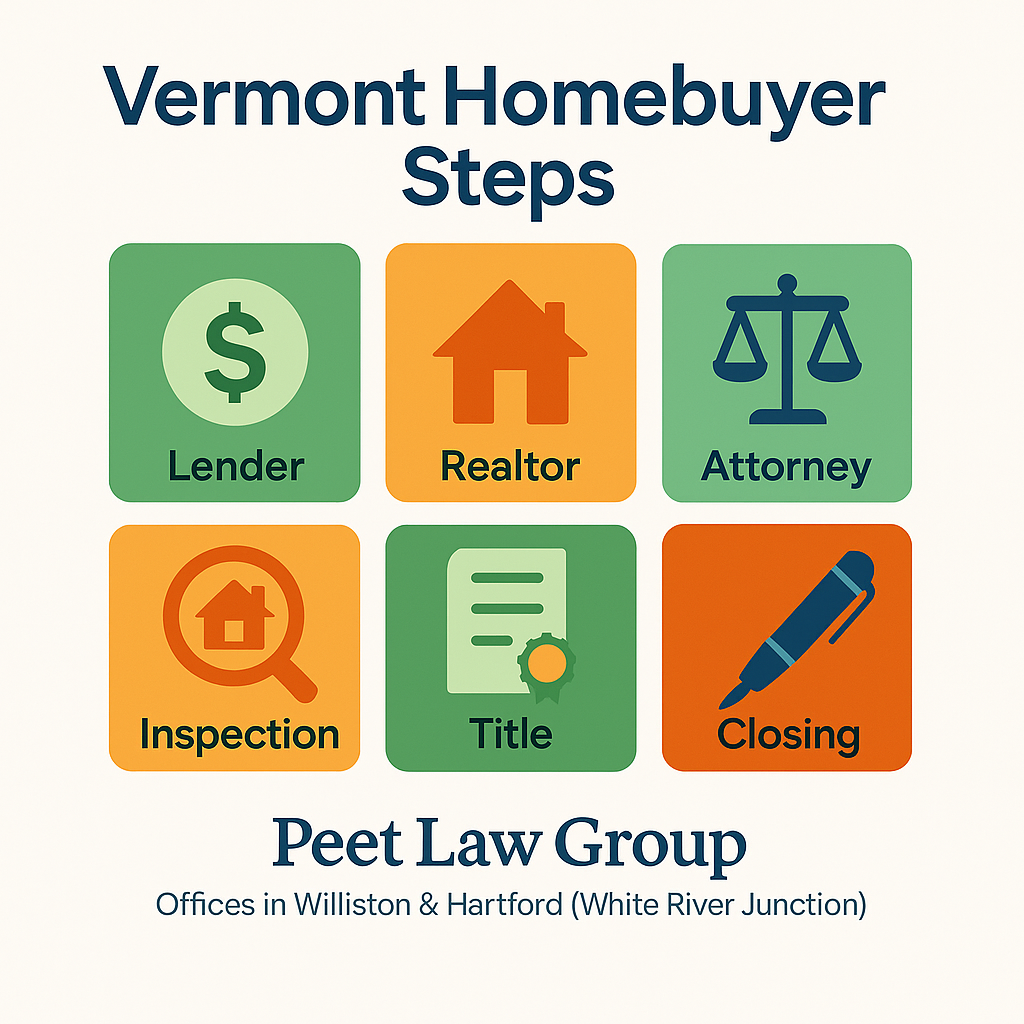

Buying a home in Vermont is exciting, but there are a lot of moving parts. Use this practical checklist to understand each step from the first conversation with a lender to walking out with the keys. This guide reflects how purchases typically proceed in Vermont and highlights where a Vermont real estate attorney adds value. 1) Consult a Mortgage Lender to Learn What You Can Afford Start with a lender conversation to set a realistic price range and monthly payment. Ask about estimated interest rate, points, closing costs, down payment options, and whether your loan has any special underwriting requirements that could affect timing. 2) Obtain a Pre-Qualification or, Preferably, a Pre-Approval Letter Pre-qualification is an estimate based on self-reported info. A pre-approval verifies income, assets, credit, and debts, making your offer stronger. Make sure the letter reflects the price range you intend to offer and is current. 3) Hire a Local Realtor Choose a Vermont-licensed buyer’s agent who knows your target towns and current market conditions. A good agent helps evaluate value, draft the offer, negotiate contingencies, and coordinate inspections and access. 4) Make an Offer Your offer will include price, earnest money, proposed closing date, financing and inspection contingencies, items to remain with the property, and deadlines. Be specific on what happens if issues are found and how deposits are handled. 5) Hire a Vermont Real Estate Attorney In Vermont, buyers commonly engage counsel early. Your attorney explains contract terms, negotiates protective language, tracks deadlines, reviews title, and coordinates closing, taxes, and recording. Engaging counsel promptly keeps the transaction on schedule. 6) Attorney Contract Review Your attorney reviews the Purchase and Sale Contract for timeline feasibility, inspection and financing protections, title and survey provisions, well and septic language where applicable, and remedies for default. If needed, your attorney proposes addenda or amendments to fix gaps before everyone is committed. 7) Submit the Full Mortgage Application Turn your pre-approval into a complete application. Provide signed disclosures, updated pay stubs, tax returns, bank statements, and any documentation your lender requests. Confirm the loan program and lock strategy. 8) Stay On Top Of Lender Requests For Information Underwriting is document-driven. Respond quickly to conditions such as large-deposit letters, updated statements, homeowners insurance binder, and verification of employment. Delays here are a leading cause of missed closing dates. 9) Appraisal The lender orders an appraisal to confirm value supports the loan. If it comes in low, options include price negotiation, a larger down payment, or reconsideration of value with additional comps. Your contract should address what happens if value is short. 10) Home Inspection Schedule licensed inspections promptly within your contingency period. Typical inspections include general home, radon, water quality, and septic where applicable. Your attorney and realtor can help draft a repair request or price concession based on results. 11) Title Search Your attorney orders a title search to confirm the seller can convey clear, marketable title and to identify mortgages, liens, easements, covenants, boundary or right-of-way issues, and municipal permit matters that must be addressed before closing. 12) Review the Title Opinion or Title Insurance Commitment You will receive a title opinion or a title insurance commitment showing required “title curatives,” such as discharges of prior mortgages or releases of liens. Your attorney works with the seller’s side to clear these items. Ask about lender’s and owner’s title insurance coverage, exceptions, and one-time premium cost. 13) Closing Preparation A few days before closing, confirm your final loan terms, cash to close, and wiring instructions. Review your closing disclosure, homeowners insurance, and any association documents. Schedule a final walk-through to verify condition and agreed repairs. 14) Closing In Vermont, closings typically occur at the attorney’s office or lender’s office. You will sign the note, mortgage, and other lender documents, as well as the closing disclosure. Your funds are usually wired the morning of closing. Your attorney confirms that title requirements are satisfied and that the deed and mortgage are in recordable form. 15) Recording After signing and funding, the deed and mortgage are submitted to the Town or City Clerk for recording. Recording creates public notice of your ownership and the lender’s security interest. Your attorney also handles Vermont forms and municipal requirements as applicable. 16) Keys Once the closing is complete and documents are released for recording, you receive the keys and access instructions. Change exterior locks soon after possession, set up utilities, and store your closing package and title policy safely. If you want a clean, worry-free closing in Vermont, Peet Law Group can help with contract review, title search, title insurance, and the entire closing process. We serve buyers across the state from our offices in Williston and Hartford (White River Junction). Contact us today at: https://www.peetlaw.com/schedule-real-estate-lawyer-consultation